Advertiser Disclosure: The Rewards Mom has partnered with CardRatings for our coverage of credit card products. The Rewards Mom and CardRatings may receive a commission from card issuers.

Ever wonder if you’re actually getting a good deal when you use your points? You’re not alone. I get this question a lot, and the truth is, not all points are created equal. A quick calculation can help you decide whether to hit redeem or save those points for something better.

If you’re just getting started with travel rewards, I go over all of this (and more) in my Beginner’s Guide to Points and Miles, but let’s walk through the basics here.

Why Point Value Matters

Think of points like money with different exchange rates. For example, 1,000 points from one program might be worth twice as much as 1,000 from another. A flight might give you incredible value, while redeeming those same points for a gift card? Not so much.

If you want to make the most of what you’ve earned, knowing the value of a point is key.

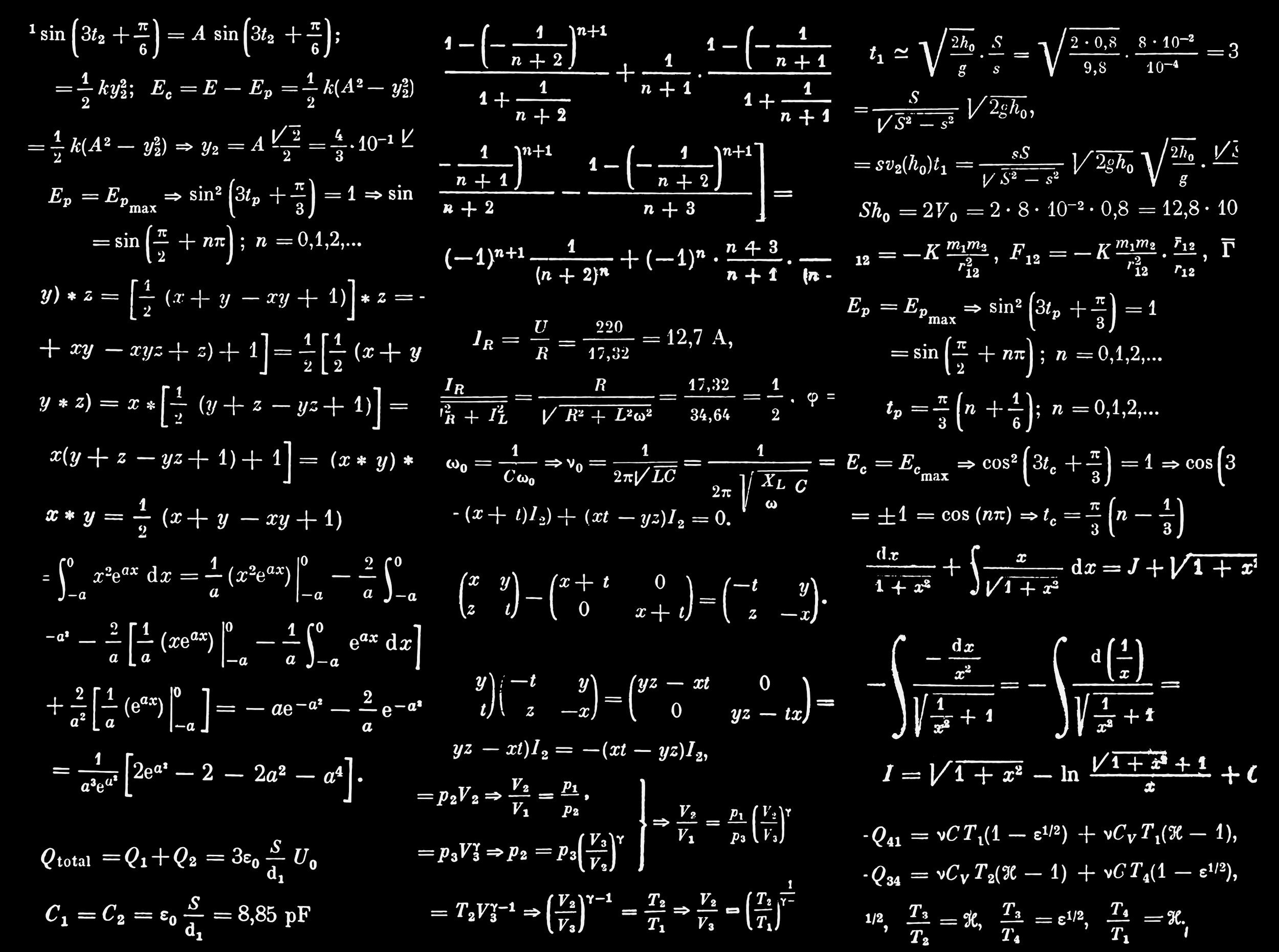

The Easy Math: How to Calculate Point Value

Points Value Calculator (Cents per Point)

Examples You’ll Actually Use

Let’s look at a few real-world examples:

Flight Redemption

- You find a roundtrip economy flight to Europe for $800 or 50,000 airline miles.

- $800 ÷ 50,000 = 1.6 cents per point.

- That’s above average, so I’d call that a win.

Hotel Redemption

- You’re looking at a hotel that’s $300 per night or 50,000 points.

- $300 ÷ 50,000 = 0.6 cents per point.

- That’s lower than average for hotel points, so you might want to pay cash and save your points.

Gift Card Redemption

- A $50 gift card costs 5,000 points.

- $50 ÷ 5,000 = 1 cent per point.

- Not terrible, but not amazing either—especially compared to what you could get by transferring those points to travel partners.

Want Better Value from Your Points?

Final Thoughts

You work hard to earn your points, so don’t waste them. A quick value check before you redeem can help you avoid low-value options and save those rewards for a trip that will really save you in the long run. Once you get the hang of it, you’ll spot a “good” redemption in seconds.

Want to see which cards earn the kind of points that stretch furthest? Here’s a list of some of my favorite travel rewards cards:

Check them out here

And if you’re looking for more hands-on help, come join me on Instagram, hop into the Facebook group, or grab my step-by-step beginner’s guide. You’ve got this, and I’m here to help every step of the way.

VIEW THE COMMENTS